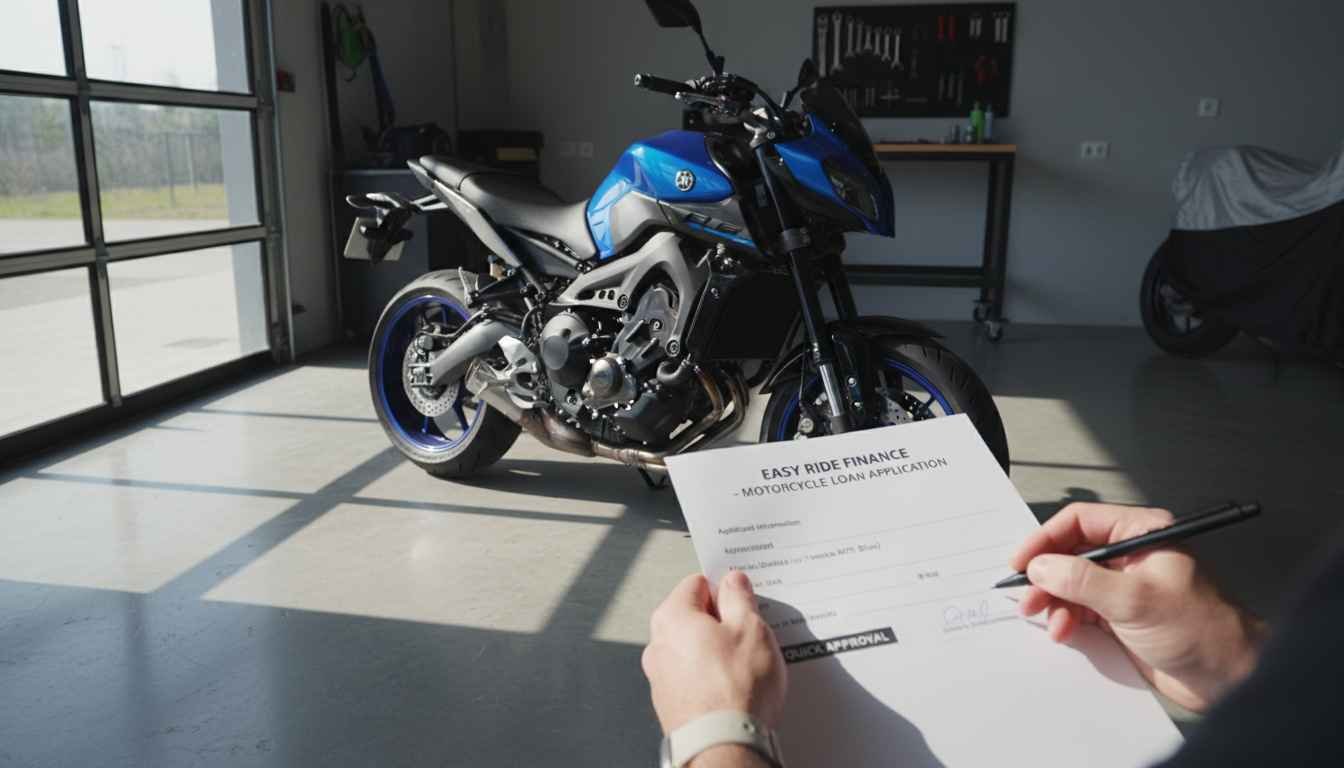

For motorcycle enthusiasts, few machines hold the allure and excitement of the Yamaha MT09. With its sleek design, powerful engine, and advanced features, the MT09 is a machine that commands attention on the road. However, financing such a powerful machine can seem like a daunting task. But with the right approach, securing MT09 finance options has never been easier. In this guide, we’ll explore everything you need to know about financing the Yamaha MT09, ensuring you ride off into the sunset without the stress of financial strain.

Why the Yamaha MT09 is Worth the Investment

When it comes to motorcycles, the Yamaha MT09 stands out as a truly exceptional option for riders of all experience levels. Its dynamic design blends aggressive styling with functionality, making it a must-have for anyone passionate about motorcycles. From its outstanding handling to the thrilling performance it delivers on every ride, the MT09 is engineered for those who crave both power and style. It’s no surprise that many riders find themselves asking how they can afford such a prestigious machine.

With its affordable financing options, the MT09 can be within reach even for those who may have previously thought the bike was out of their budget. Yamaha understands the importance of offering flexible payment plans, allowing enthusiasts to spread out the cost of this incredible motorcycle over time. Whether you’re looking to buy new or used, there are a range of financing options designed to make your dream bike a reality without compromising on quality.

Exploring MT09 Financing: What Are Your Options?

The road to owning a Yamaha MT09 begins with choosing the right financing option. For many, securing the best deal can be a crucial factor in making the purchase. There are various options available for MT09 financing, each catering to different financial situations. One popular option is a secured loan, where the motorcycle itself serves as collateral. This type of loan typically offers lower interest rates, making it a great choice for buyers looking to save money in the long run.

Another option is an unsecured loan, which doesn’t require collateral. While this option may come with slightly higher interest rates, it offers the flexibility of not having to put your property on the line. Financing through a dealership is another common route, where you can arrange monthly payments directly with the seller. Yamaha dealerships often provide exclusive financing offers, such as low-interest rates or special terms, making it an attractive option for many buyers.

How to Qualify for MT09 Financing: Key Considerations

Before jumping into the world of MT09 finance, it’s essential to understand the factors that lenders will consider when evaluating your application. Lenders typically look at your credit score, income, and debt-to-income ratio to determine your ability to repay the loan. Having a higher credit score will increase your chances of securing a favorable loan with lower interest rates. However, even if your credit score isn’t perfect, there are still options available for financing the MT09.

Some dealerships offer special financing plans for buyers with less-than-ideal credit, making it possible to obtain financing despite challenges. It’s important to shop around and compare offers to find the best deal. Additionally, being prepared to make a down payment can increase your chances of approval and potentially reduce the amount you need to finance. Taking these factors into account will help you navigate the financing process more effectively.

Understanding Interest Rates and Monthly Payments

Interest rates play a significant role in the total cost of your MT09 financing. The rate at which you are charged interest will determine how much you ultimately pay for the motorcycle. Lenders offer varying interest rates depending on factors like your credit history, loan term, and the amount you’re borrowing. Generally, shorter loan terms come with lower interest rates, but higher monthly payments. On the other hand, longer loan terms result in lower monthly payments but can cost more in interest over the life of the loan.

When considering your MT09 financing options, it’s essential to balance the loan term and interest rate to fit your financial situation. For example, if you’re looking for a manageable monthly payment, a longer loan term may be more appropriate. However, if you’re able to pay more each month, a shorter loan term with a lower interest rate could save you money in the long run. The key is to find a loan structure that works best for you while ensuring you can comfortably afford the payments.

The Role of Credit Score in MT09 Financing

Your credit score is one of the most important factors in securing favorable financing for the Yamaha MT09. A higher credit score can help you qualify for lower interest rates, potentially saving you hundreds or even thousands of dollars over the life of the loan. However, it’s not just about having a good credit score; the overall health of your credit report matters too. Lenders will examine your payment history, credit utilization, and any outstanding debt to assess your risk as a borrower.

If your credit score is below the ideal range, don’t panic. There are still financing options available for individuals with less-than-perfect credit. Some lenders specialize in working with borrowers who have poor credit, offering higher interest rates to compensate for the increased risk. However, these loans can still provide you with the opportunity to own a Yamaha MT09. It’s essential to review your credit report and, if necessary, take steps to improve your score before applying for financing.

Benefits of Yamaha Dealership Financing

One of the most convenient ways to secure financing for the Yamaha MT09 is through a Yamaha dealership. Many authorized dealerships offer exclusive financing deals that can make purchasing the bike easier and more affordable. These deals may include low-interest rates, cash rebates, or even zero-percent financing for qualified buyers. Additionally, financing through the dealership often comes with the benefit of easy integration with the purchase process, meaning you can handle everything in one place.

Dealership financing also offers the advantage of streamlined approval processes, as they typically work directly with lenders who specialize in motorcycle loans. This can expedite your loan approval and ensure that you’re riding your new MT09 sooner rather than later. Additionally, dealership financing often comes with flexible terms, allowing you to customize your payment plan to fit your budget and preferences.

What to Consider Before Signing a Financing Agreement

Before committing to any MT09 financing deal, it’s crucial to thoroughly read and understand the terms of the agreement. Pay close attention to the interest rate, loan term, and any additional fees that may apply. Some loans may include hidden fees or prepayment penalties, which could affect your ability to pay off the loan early or make extra payments without incurring additional charges.

It’s also essential to ensure that the monthly payment is affordable within your budget. While it’s tempting to opt for lower monthly payments, a longer loan term may end up costing you more in the long run. Always factor in the total cost of the loan, not just the monthly payment, to get a clear picture of what you’ll be paying overall. By carefully reviewing the financing agreement, you can make an informed decision and avoid any surprises down the road.

Real-World Experiences with MT09 Financing

Many Yamaha MT09 owners have shared their experiences with financing, offering valuable insights into what it’s like to secure a loan for this powerful machine. Some have found that dealership financing provided the most straightforward and hassle-free process, while others have opted for bank loans or credit unions to secure more competitive interest rates. Regardless of the route they took, many riders agree that financing the MT09 was a worthwhile investment due to the bike’s exceptional performance and longevity.

One rider shared how they used a combination of their savings and dealership financing to purchase the MT09. By putting down a substantial down payment, they were able to secure a lower monthly payment and favorable loan terms. Another rider mentioned how they financed their MT09 through a credit union, which offered a lower interest rate than the dealership financing options available at the time. These real-world experiences highlight the importance of shopping around for the best deal and understanding your financing options before committing to a loan.

Conclusion: Ride the Yamaha MT09 with Confidence

With the right financing plan in place, owning a Yamaha MT09 can become a reality sooner than you think. Whether you choose dealership financing, a bank loan, or another option, the key is to find a solution that fits your financial situation and allows you to enjoy the thrill of riding this extraordinary motorcycle. Don’t let financial worries hold you back – take advantage of the many financing opportunities available and get behind the handlebars of the Yamaha MT09 today!

In conclusion, the Celtic Finance Institute offers invaluable resources and guidance to help you navigate your journey towards financial prosperity. Embrace the opportunities and take the first step by exploring this Meta Title for a brighter financial future.